AMM vs. Order Book: Contrasting Trading Models for Crypto

In the complex world of cryptocurrency trading, two primary trading models stand prominent - traditional Order Book Exchanges and the newer Automated Market Makers (AMMs). These models, while sharing a common goal of facilitating trade, follow quite different paths to achieve it. Understanding these differences is crucial for everyone, from those who have just set foot in the world of cryptocurrencies to the most seasoned traders.

Let's take a closer look at these two models, breaking down how they work, their benefits, and potential pitfalls.

Understanding AMMs

Automated Market Makers (AMMs) represent a new wave in the field of cryptocurrency trading. Unlike order book exchanges, AMMs use a different model to facilitate trades. Rather than relying on buyers and sellers to make and take offers, AMMs use mathematical algorithms and smart contracts to automatically set the price of a token based on its supply and demand.

In an AMM, anyone can become a liquidity provider by depositing tokens into a liquidity pool. These pools are then used to execute trades, with the trading price determined by the ratio of the tokens in the pool. This system is fully automated, eliminating the need for an order book.

While AMMs have their advantages, such as enabling permissionless trading and offering potential earnings for liquidity providers, they also have their drawbacks. One of the most significant is 'impermanent loss,' a temporary loss that liquidity providers can face if the price of their deposited tokens fluctuates.

Two well-known examples of AMMs are Uniswap and SushiSwap. Each platform showcases its own approach to AMM-based trading, shaping the current state of decentralized cryptocurrency trading.

Understanding Order Books

At its core, an Order Book Exchange is a traditional model that uses a list to organize buy and sell orders for a specific cryptocurrency. These orders are sorted by price level, and they represent the live market demand for a cryptocurrency. The order book records these transactions in real time, providing a detailed insight into the market activity around a particular cryptocurrency.

The order book typically consists of three parts:

- buy orders;

- sell orders;

- the order history.

Buy orders record all the bids, showing the amount that buyers are willing to purchase. Sell orders, on the other hand, include all the asking prices that people are willing to sell. The order history documents all the transactions that have occurred.

The key strength of Order Book Exchanges lies in their transparency and control. Traders can see at a glance the level of market interest in a cryptocurrency, and they have the ability to set their own prices for buy or sell orders. This level of insight and control is appealing to many traders, especially those involved in high-volume trading.

Many centralized exchanges (CEX), like Binance, operate with an order book, offering a wide range of cryptocurrencies and high volumes.

Here at C3, we're embodying a unique example of innovation in the domain of Order Book Exchanges. By merging the user-friendly experience of a CEX with the self-custody and transparency of a DEX, we're showcasing the possibilities of the next generation of hybrid exchanges.

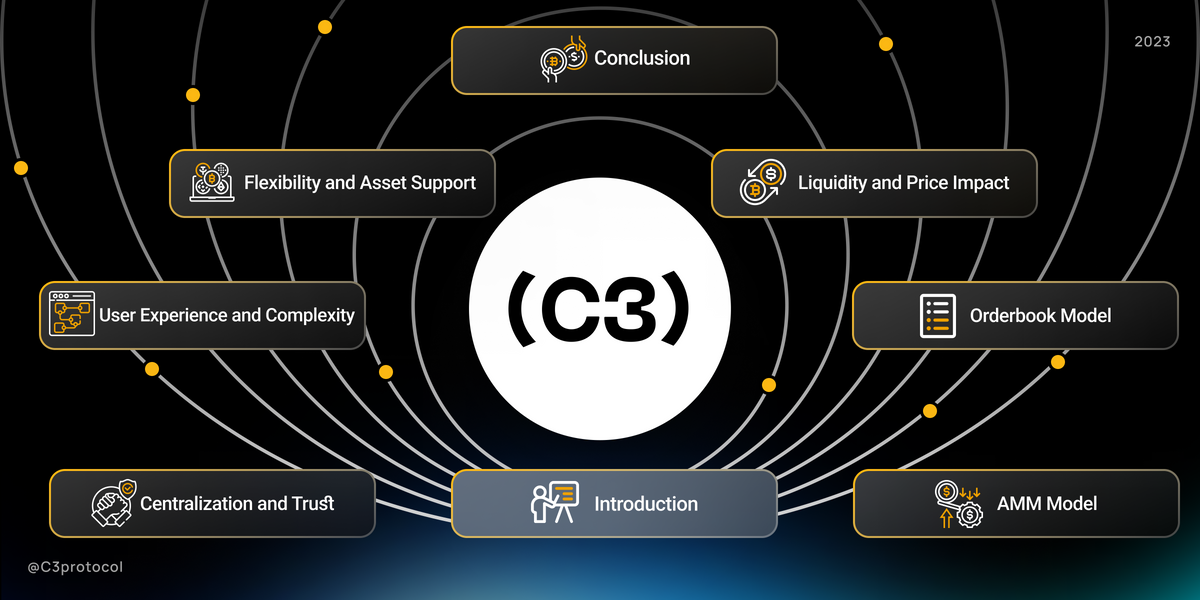

Deep Dive: AMM vs. Order Book

Diving deeper into the mechanics of both trading models, we will explore four key aspects: liquidity and price impact, flexibility and asset support, user experience and complexity, and centralization. Each of these aspects influences a trader's experience and decisions. We'll unpack how Order Book Exchanges and AMMs differ in these areas, highlighting their unique features, benefits, and challenges.

Liquidity and Price Impact

AMMs bring continuous liquidity to the table. Their unique algorithmic approach ensures that trades can always be executed, no matter the token pair or trade size. However, they have an inherent drawback known as 'slippage.' Slippage refers to the difference between the expected price of a trade and the executed price, and it tends to increase as trade size goes up.

On the other hand, traditional Order Book Exchanges are well-known for their capacity to handle larger trades with lower slippage. However, during times of market turbulence or lower activity, these exchanges might encounter challenges in maintaining their liquidity levels, which could impact the immediate execution of trades.

While in these situations, traders in AMMs could withdraw liquidity to avoid losses, there is still a tradeoff. LPs in AMMs often face the challenge of impermanent loss due to their limited flexibility in how they provide liquidity, leaving them exposed to market risk.

Flexibility and Asset Support

AMMs are marked by their flexible asset support, welcoming an extensive array of tokens, even the newest ones entering the crypto market. This broad embrace makes AMMs a fertile ground for those keen on venturing into emerging opportunities.

On the other hand, order book exchanges follow a more cautious path. They enforce stricter listing criteria, favoring well-established, proven assets. While this approach might limit the variety of assets, it ensures robust liquidity for popular trading pairs, offering a degree of stability and predictability that many traders are looking for.

User Experience and Complexity

AMMs score high on user experience, offering a straightforward, intuitive interface that attracts beginners in the cryptocurrency world. With no complex charts or intricate order types, they make the trading process seamless.

Conversely, order book exchanges present a steeper learning curve. Detailed information and advanced trading features can be daunting for newcomers. However, experienced traders appreciate these complex tools for the comprehensive market insights and sophisticated trading strategies they enable.

Hence, while AMMs appeal to those seeking simplicity, order book exchanges cater to the needs of seasoned traders seeking depth and detail.

Centralization and Trust

AMMs are decentralized, removing the need for intermediaries and reducing custodial risks. In contrast, many of the traditional order book exchanges are centralized, handling users' funds and transactions, which can lead to concerns about trust and potential vulnerabilities.

To mitigate this, next-generation hybrid exchanges, like C3, offer a unique approach that combines the self-custody feature of AMMs, promoting a sense of control and security among its users.

Conclusion

As we've seen, both Order Book Exchanges and Automated Market Makers serve crucial roles in the world of cryptocurrency trading. Order Books, with their advanced functionalities and market depth, are preferred by seasoned traders, while AMMs, with their user-friendly interfaces and permissionless trading, have democratized access to the market, appealing especially to new entrants.

As the crypto space matures, hybrid models like C3 are emerging that aim to integrate the benefits of both systems, reflecting continuous innovation in the field. Ultimately, the choice between these models depends on an individual trader's strategy, expertise, and risk tolerance.