C3 Community AMA: Your top 12 questions, answered

We received more than 50 questions from our community about the structure, business, and goals of our organization.

Community is the foundation for every goal we will achieve at C3. We listen to our users, understand their feedback, and implement it. As part of our strategy to create more direct lines of communication with our community, we have recently launched the C3 AMA series, with Michel Dahdah, CEO and co-founder of C3. We received more than 50 questions from our community about the structure, business, and goals of our organization.

Join the discussion in our global Telegram and Discord communities today and let us know what AMA we should do next!

How would you describe the problems you would like to solve, in simple terms?

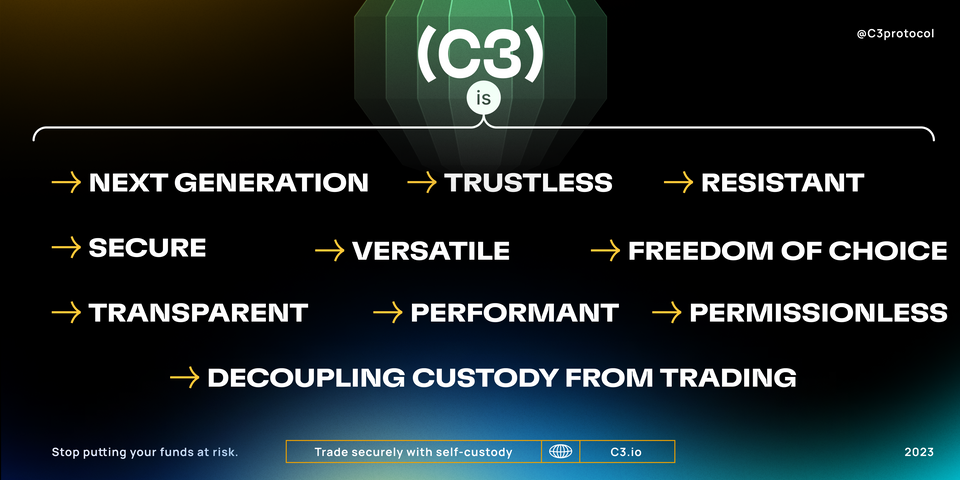

Our goal is to address several key issues that have been holding back the growth of the crypto space. One of the main problems we're focused on is the insolvency risk and counterpart issues that have plagued the industry for years. We're also working to improve the user experience of DeFi, which can be difficult and confusing for many people to navigate. We believe that by solving these problems, we can help unlock the full potential of crypto and bring it into the mainstream.

What made you choose the name C3? Is there a meaning to this?

C3 is a global name, no matter what language you speak you will be able to spell it correctly. Also it is short enough that it will make phishing attacks harder as the URL is very easy to discern.

C3 stands for Cross-chain Cross-collateral Clearing Engine.

How did you come to choose Algorand as the infrastructure for C3?

C3 uses the Algorand blockchain for its on-chain component and trade settlement. Algorand’s transaction cost is low enough to allow C3 to fully subsidize all on-chain transaction fees. Algorand's high throughput is also capable of processing all trade settlements from matched trades, even at peak volume. Furthermore, Algorand supports cryptographic primitives necessary to verify signatures covering the cryptography of most blockchains without requiring the development of independent smart contracts, reducing C3’s complexity. Algorand's atomicity is also essential for C3, as complex trade settlements require multiple operations to happen atomically. For example, a leveraged trade involves borrowing funds from the lending pool, transferring those funds to the seller, and delivering the sold assets all at once, which is made possible by the concatenation of multiple operations into a single group that all settle atomically on-chain.

What contributions, incentives, or ambassador programs do you have, or plan to announce?

We strongly believe that without a great community C3 will not succeed in its mission. Community efforts and incentives are definitely in the plans as we want to create the best community in the ecosystem. We are working on defining these plans as we know they have to be thought of very carefully. We are happy to receive and consider the best ideas from our growing community as part of this process.

Are individuals and institutions able to use the C3 exchange, or is it designed specifically for a particular type of user?

C3 is specifically designed to serve both individual and institutional users. Its high-throughput trading architecture is particularly suitable for algorithmic traders and market makers, with direct API and web socket connectivity and no limitations from blockchain technology. Moreover, the system enables the integration of institutional custodians so that institutions can trade while keeping custody with their custodians of choice. Meanwhile, retail users can access the platform from any wallet and blockchain they prefer. C3 also offers a range of features familiar to individual users of traditional exchanges, such as conditional orders like stop loss, trailing orders, and take profit orders. The user interface is designed to be very intuitive and user-friendly for all.

How does the C3 token benefit users?

No plans have been announced for any C3 Token so please be aware of any scams out there impersonating C3.

Is it possible for users to stake their assets on the C3 exchange? How does this work, if so?

Initially there will be no staking feature. Instead there will be lending products for those looking to earn yield on their assets. Like most traditional exchanges, C3 will offer leveraged spot trading also known as margin trading. The available margin to borrow assets to go leveraged long or to short comes from C3’s lending market. Users in C3 will be able to lend their funds out in exchange of yield paid by traders using margin. This works like most lending protocols, where lent funds are under flexible terms and can be withdrawn at any point. Yield and interest rates will vary based on the utilization rate of the pool.

Can Asian users access the C3 protocol?

Yes!

What measures will you take to control the stability and slippage of the trade on C3? Gas will be provided by what token? Do you plan to create your own coin?

C3 uses a traditional limit order book instead of an AMM architecture. This provides much better pricing flexibility given users full control over the exact price they want to get filled at without risking slippage. We are prioritizing trading in tokens with high market capitalization to start, as they generally have more liquidity in the market. This can help reduce the risk of slippage and other transaction costs.

There is no gas in C3, the only gas you pay is at the time of deposit and withdrawal like in any other exchange.

We plan on using USDC as the main stablecoin.

What are the Layer 2 scaling solutions used by the C3 exchange to enable fast and inexpensive trading?

C3 will be integrating with the most popular Layer 2s so that users in those ecosystems are able to seamlessly access and use C3. However, C3 does not use any Layer 2 to achieve its fast and inexpensive trading experience. C3’s unique hybrid architecture leverages the off-chain component to run all trade logic in a server off-chain allowing it to process trades at much higher scale than any blockchain could ever.

When the liquidity for some tokens is low, how to ensure the transaction's efficiency?

First we are prioritizing trading in large market cap tokens, those that already have a lot of liquidity throughout the ecosystem. C3 is also built for institutional trading, we expect to have market makers provide enough liquidity to listed pairs to ensure efficient and liquid markets from the initial stages of C3. Market makers are essential in increasing liquidity and ensuring efficient pricing for trades.

As the user base of C3 grows, it becomes easier to support low liquidity tokens. At that point, C3 can start to list them and provide more liquidity to the market.

Does the CLOB matching engine undergo external regulation and audit? Can C3 front run users?

We will be using a variation of Merkle Trees as a data storage and logic proof. These proofs will be posted on chain frequently and will allow anyone to audit any event processed by the server to ensure the logic of the off-chain component is behaving correctly.

Like any other exchange, by having control of the matching process we could theoretically find a way to front-run users despite posting proofs on-chain. However, given that the entire settlement activity is fully transparent and the matching mechanism will be fully disclosed it will be fairly easy for the market to analyze the on-chain data to verify if anything fishy is ever happening. This is a big reason why we believe that on-chain settlement and the transparency that it gives will make system’s like C3 much more robust.