Harnessing the Power of Pyth and Solana for Next-Generation Trading

The accuracy and timely delivery of market data are essential to decentralized finance.

C3.io's integration of the Pyth network on the Solana blockchain exemplifies our technical strategy to harness high-fidelity, real-time price oracles. Pyth, distinguished for aggregating data from a consortium of top-tier financial entities, provides an oracle service that delivers market data with unparalleled precision. Solana’s infrastructure, known for its capability to process tens of thousands of transactions per second with sub-second finality, enhances the efficacy of Pyth’s data delivery, ensuring that our platform receives accurate price feeds with minimal latency.

Optimizing Trading Strategies with Real-Time Data

By integrating Pyth's data on Solana's high-throughput network, we can not only access fast and accurate prices, but also optimize trading strategies and smart contracts. The real-time nature of Pyth’s price feeds, combined with Solana's low-latency transactions, enables C3.io to execute trades at a speed that keeps pace with market volatility.

This integration mitigates risks associated with price slippage and ensures that our users can capitalize on trading opportunities the moment they arise.

Dynamic Risk Management through Pyth’s Confidence Intervals

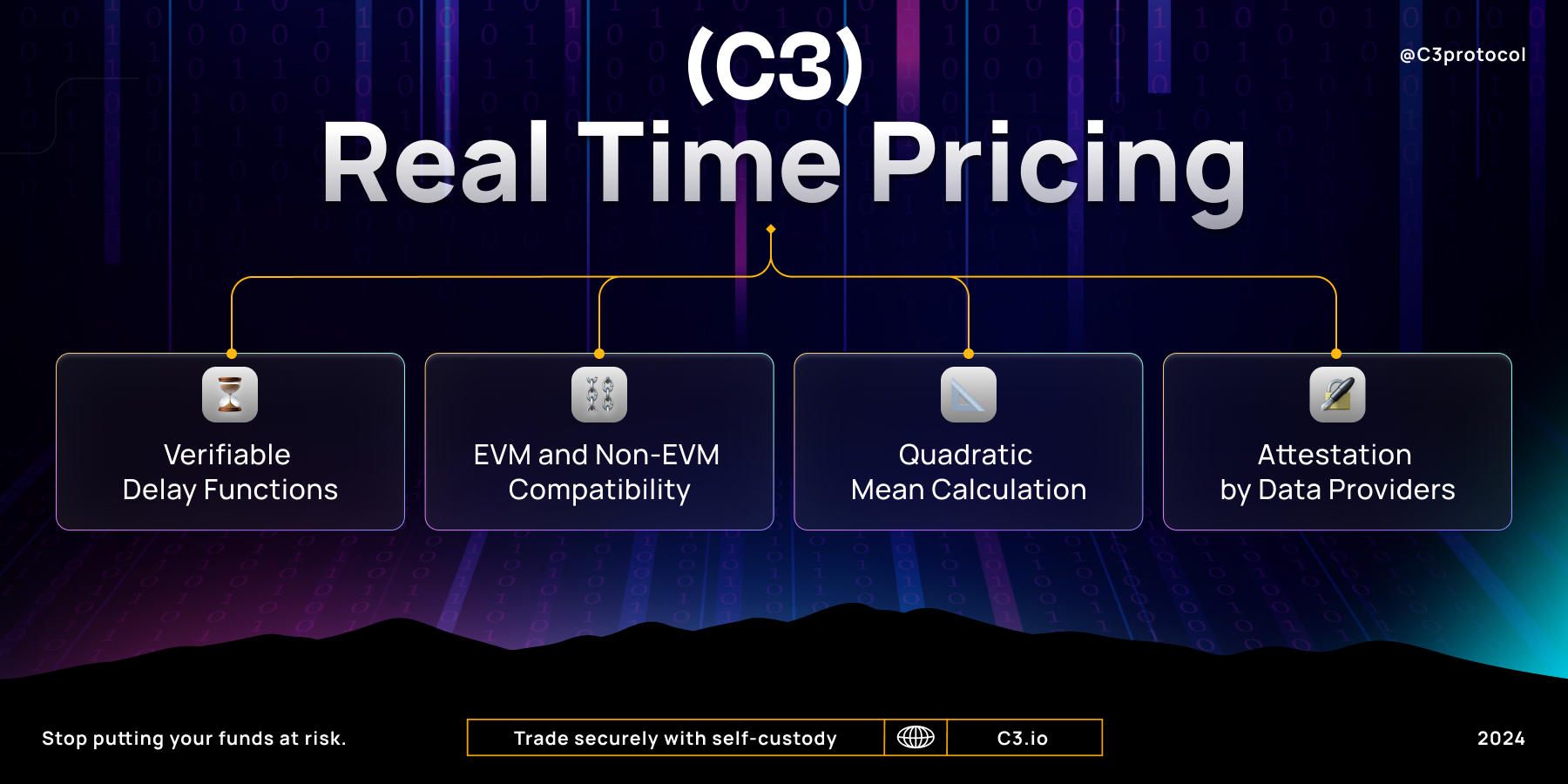

- VDF-Based Time Weighting: Pyth utilizes Verifiable Delay Functions (VDFs) to weight price contributions based on their submission time, ensuring that more recent data has a greater impact on the aggregated price, enhancing the oracle's responsiveness to market changes.

- EVM and Non-EVM Compatibility: Designed for compatibility across both Ethereum Virtual Machine (EVM) and non-EVM blockchains, Pyth's architecture enables a wide-ranging deployment, facilitating cross-chain price oracle services.

- Quadratic Mean Calculation: To compute the aggregate price and confidence interval, Pyth applies a quadratic mean (RMS) of individual price contributions, which balances outlier resistance with sensitivity to true market movements.

- Attestation by Data Providers: Data providers sign their price updates with private keys, and these signed attestations are published on-chain. This cryptographic proof ensures the authenticity and integrity of the data source, bolstering the trustworthiness of the price feed.

The application of Pyth’s confidence intervals on Solana's scalable blockchain represents a significant advancement in dynamic risk management.

This feature allows C3.io to adjust its pricing in real-time, responding to the inherent volatility and liquidity conditions of cryptocurrency markets. By integrating these confidence intervals into our risk management framework, we provide our users with a more sophisticated and responsive trading platform.

C3 On-Chain Smart Contracts

C3's integration with the Pyth network is facilitated through its on-chain smart contracts, notably the Cross-collateral Clearing Engine and the Health Calculator, which operate on the Algorand blockchain. The Cross-collateral Clearing Engine, C3’s core smart contract, manages user funds, trade settlements, and various financial operations with cryptographic verification of user signatures. Its embedded Lending Pool supports margin trading by allowing users to lend funds. The Health Calculator smart contract, acting as the on-chain risk engine, leverages Pyth's price feeds for real-time asset valuation, ensuring the financial health of accounts independently from off-chain computations.

Setting a New Standard in Trading

The collaboration between C3.io, Pyth, on the Solana blockchain is a testament to our dedication to technological excellence and innovation in the DeFi space.

By prioritizing high-speed, accurate, and secure trading solutions, we are setting a new standard for what traders can expect from a cryptocurrency exchange. As we continue to explore and integrate advanced technologies, our commitment to improving the trading experience and financial outcomes for our users remains unwavering.